AGIL::UID

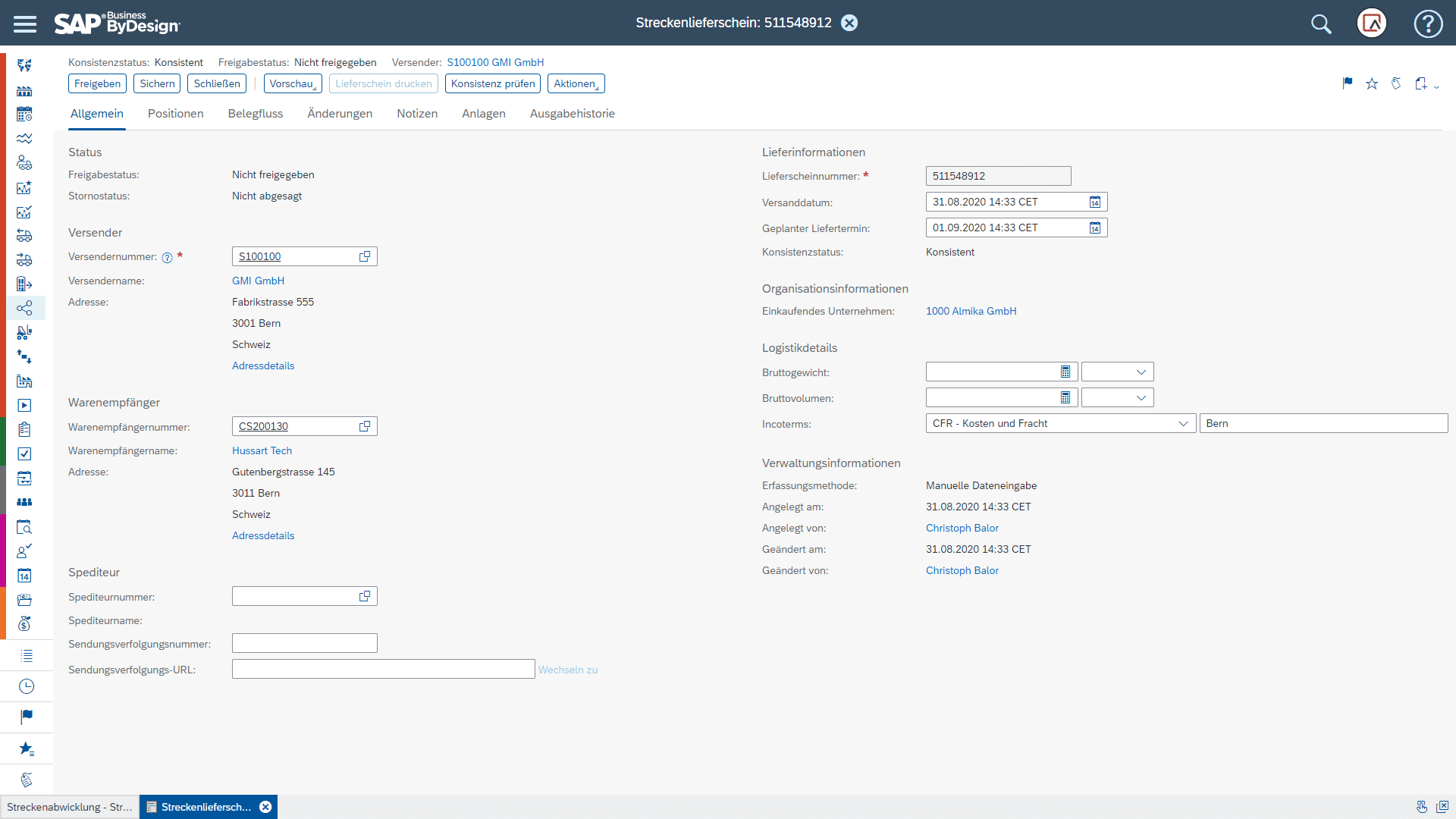

Companies must review existing processes and delivery scenarios due to the new legal requirements of the VAT Act as of 01.01.2020.

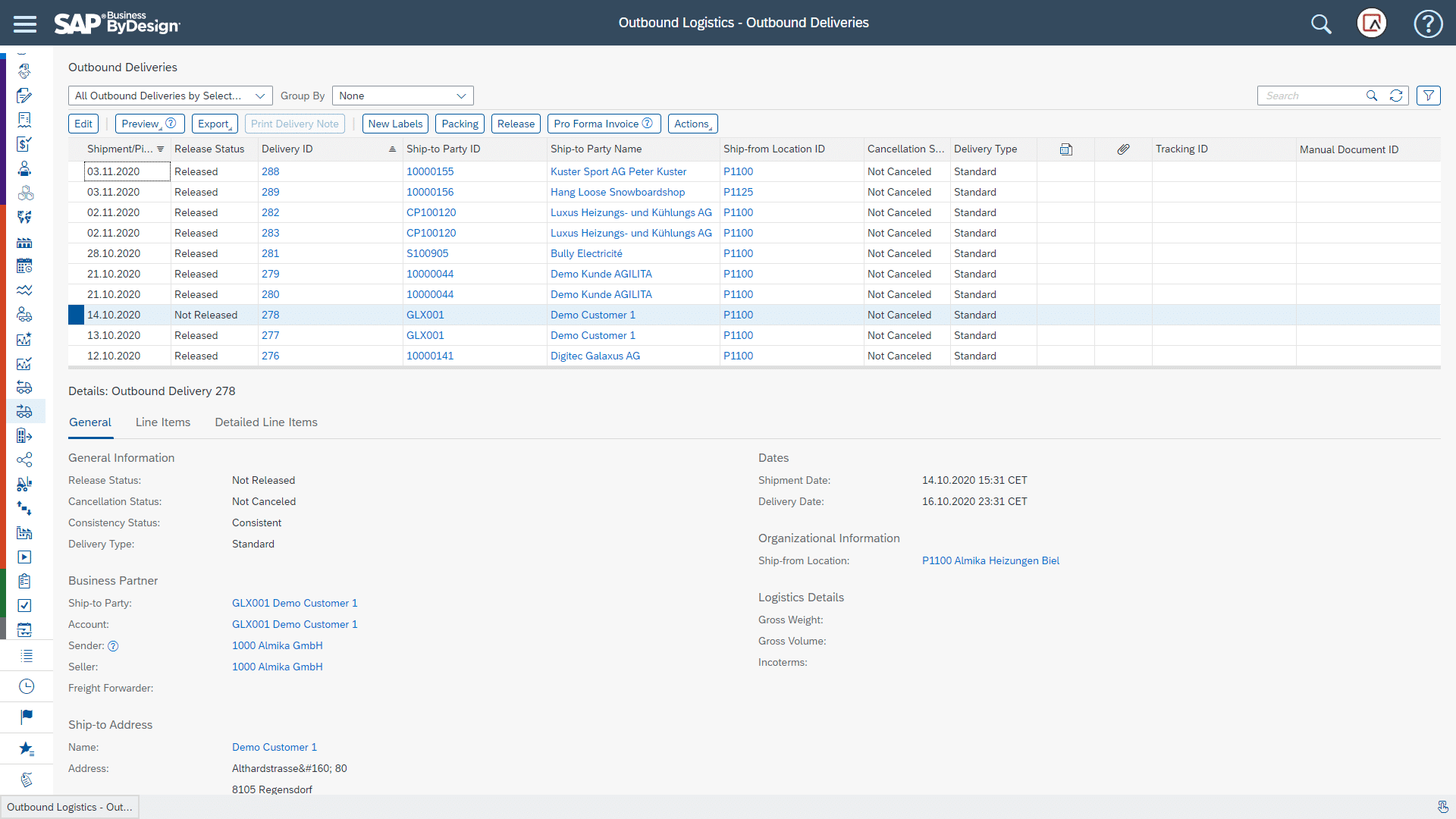

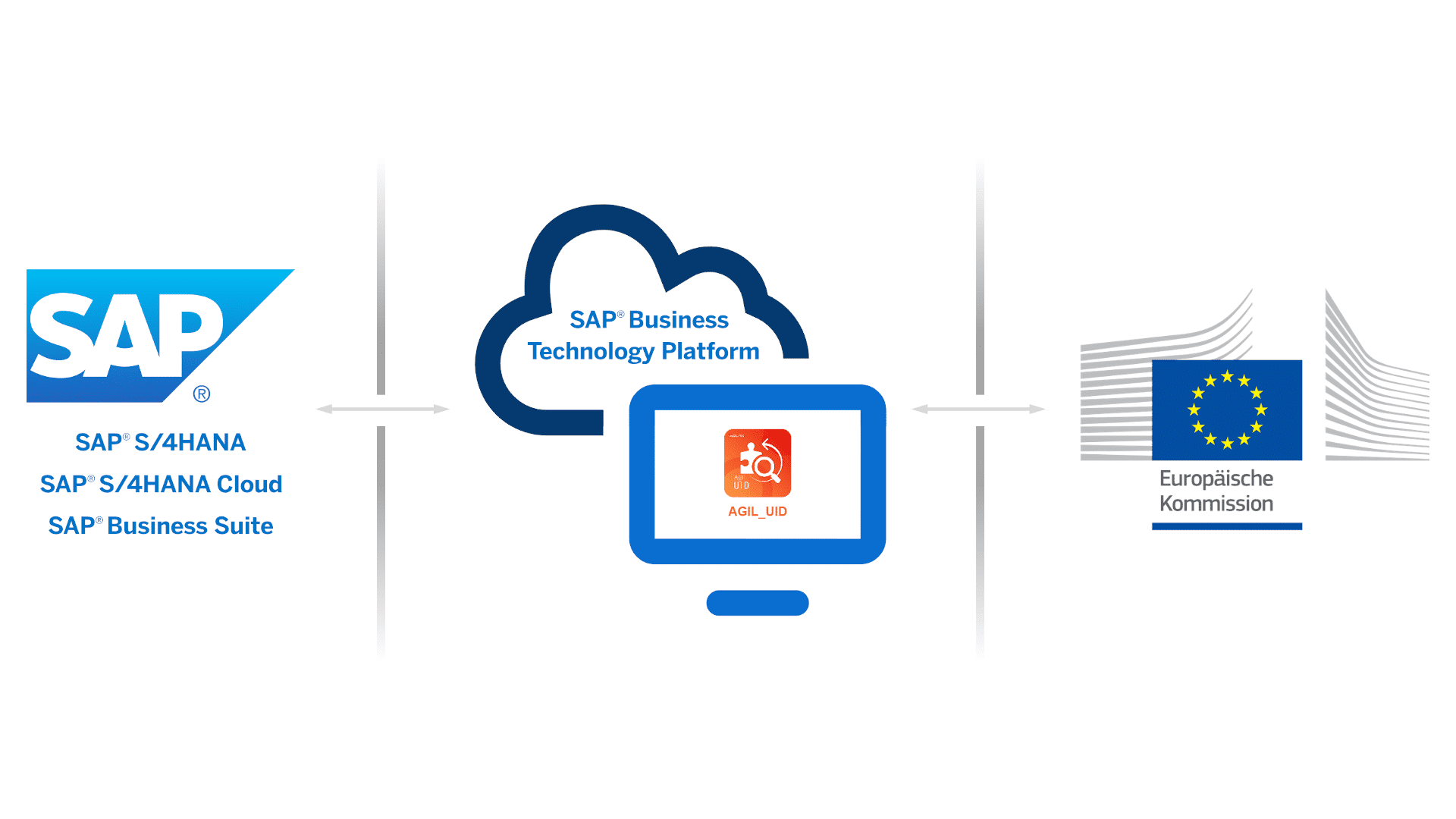

Thanks to automatic validation of company identification numbers (UID), your processes meet the legal requirements at all times. Customs Administration or the European Central Bank are queried and updated directly in your SAP Core system.

Real-time validation

The validation of the VAT ID is always done in real time with the online VAT Information Exchange System (VIES) of the European Commission.

Decisive advantages

CFO AC Immune SA

Learn more

Request a free online demo with a product expert now or view the product flyer.